how do business loans work in canada

The borrower receives a sum of money from the lender which is frequently a corporation financial organization or government. A loan is a type of debt that a small business takes on.

Small Business Loans Td Canada Trust

How does it work.

. Business loans provide your company with funding for any business-related expenses like growth filling in cash flow gaps and covering other expenses. How do I find out how business loans work from the government. 2 days agoAt the end of August Biden canceled 10000 in student loan debt per borrower and 20000 in student debt for those who used Pell Grants to attend college.

Car loan debt plus any fees and. This is a loan specifically for small businesses that can be used for a variety of. Ad Get Your Small Business Funded Fast.

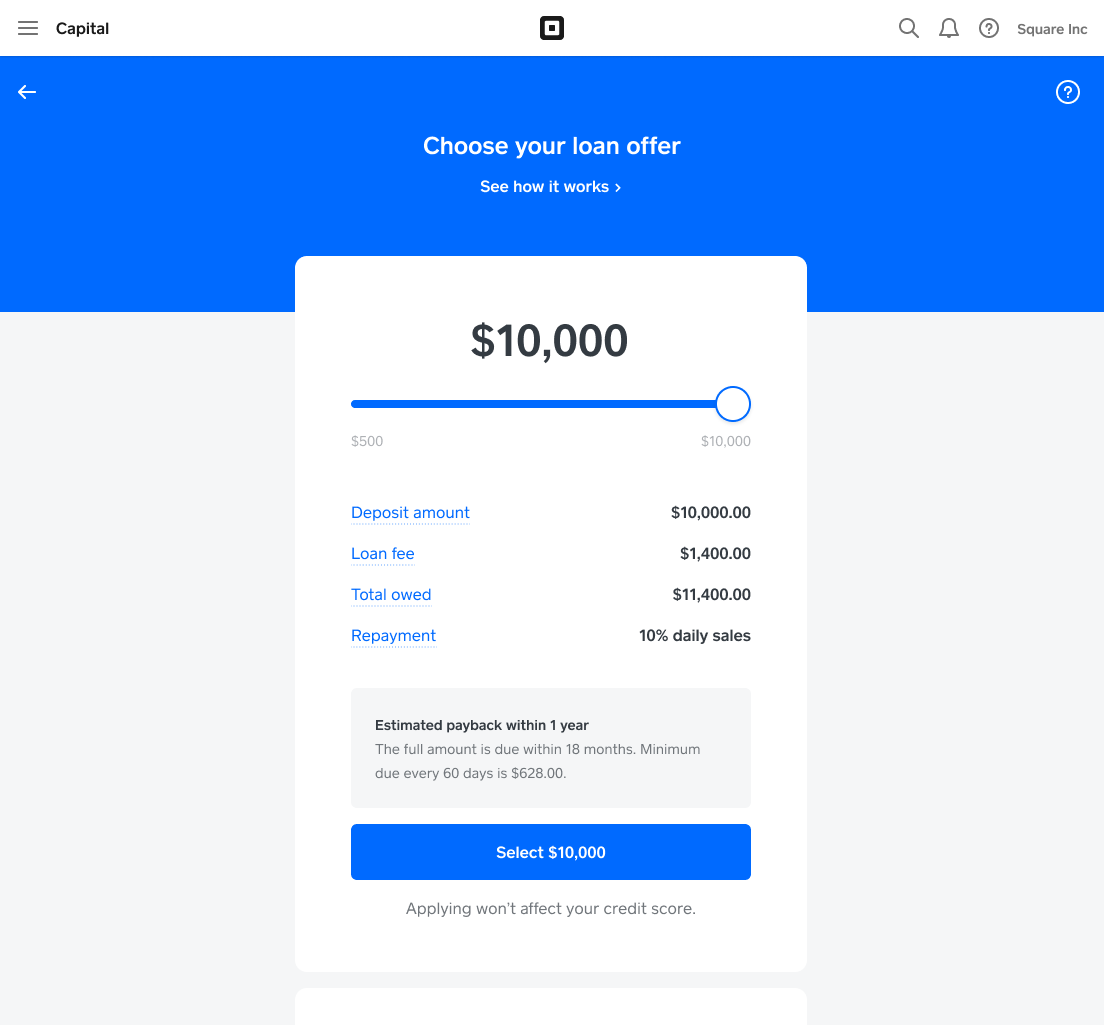

Money is borrowed from banks or alternative lenders and then paid back in equal installments over an agreed period of time. Loans in Canada are generally lump sums of money that you borrow for a specific period of time usually paid back in instalments for which you are charged interest. Asked By Bella Youngs.

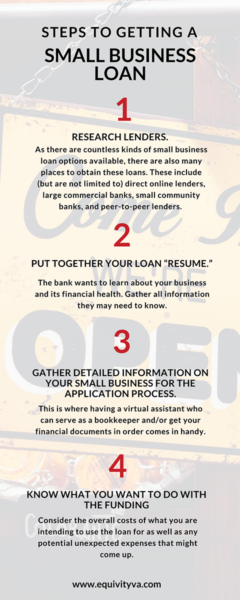

In Canada a student loan is financing the provincial and federal government provides to help pay your college or university tuition. Small businesses looking to purchase or improve their assets for new or expanded operations could benefit from the Canada Small Business Financing Loan CSBFL. BDC Canadas government owned bank for small business and entrepreneurs offers an easy 3-step process for getting a loan of.

Spring Financial Personal Loan. Get Business Loan Now. Best Business Loans in Canada - Comparewise Business loan rates in Canada 4 Results 1 Choice 5000 - 500000 Loan Amount Starting at 1299 APR Range Apply in 30.

Applying for a business loan is easier than ever. How do business loan interest rates work in Canada. Your first option is to take out a loan with the Canada Student Loans Program which enables the Canadian government to provide funding for full-time and part-time.

This loan is a. The most common types of government loans for businesses in Canada are. The main reason is that if the lender can match the loan to the businesss need it reduces the risk on both parties.

The total amount repaid will include the. Further a business wants a business loan to work for them. It may also cover other expenses such.

We can help connect you with the top business financing providers in Canada. 9 - 48 months. Top Business Loans and Financing for Renovations Providers in Canada.

The Small Business Loan. BDC Canadas government owned bank for small business and entrepreneurs. A car loan is a sum of money you borrow from a bank credit union car dealership or online lender to fund the purchase of a new or used vehicle.

Income 1800month 3 months employed min.

Commercial Secure And Unsecure Loans Priority Lending Commerical Equipment Financing In Pittsburgh Pennsylvania Brampton Ontario

Average Small Business Loan Amount Bankrate

Business Loans And Commercial Mortgages Bmo Canada

How To Apply For A Canadian Business Loan Mehran Redjvani Business

Focus Bank Lending To Businesses Focus Bank Lending To Businesses

Get A Small Business Loan Online L Paypal Us

Canada Small Business Financing Loan Td Canada Trust

How Do Business Loans Work In Canada Quora

The Small Business Owner S Guide To Getting An Sba Loan Businessnewsdaily Com

How To Get A Business Loan In Canada Bdc Ca

Working Capital Loans For Small Businesses Fundbox

Everything You Need To Know About Small Business Loans Infographic Business 2 Community

/https://www.thestar.com/content/dam/thestar/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons/_1_main_mortgage_and_key.jpg)

Mortgage Brokers Vs Banks The Pros And Cons The Star

/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Credit Unions Vs Banks Which One Is The Best For You

8 Ways To Get Money To Start A Small Business

Ondeck Has Lent 6 Billion To Small And Medium Business Shawn Chittle Tech Product Leadership Product Design